Update Comment on June 11, 2012: if you don't feel like reading all of this let me sum this all up...Toronto Dominion Canada trust Bank is full of shit...Why? Because they sold an insurance policy to a self-employed person without telling them that self-employed people are excluded...All this bullshit & analysis & letters from them are a load of crap...If someone is excluded from making a claim because they are self-employed then you don't sell them an insurance policy, & then say 'well, you should have read the fine print'...Fine print excuses are for scammers, fraudsters, criminals, it is the stuff of corporate malfeasance...The fact that this bullshit runs so deep from TD bank to Canada Life Assurance company through to the OLHI & various levels of Canadian government means that our country now stinks...

When someone calls to sell me computer software they say this is WINDOWS blah blah blah, so then I know I am excluded & I say I have a MAC blah blah blah & they say "Oh sorry" & go away...TD Visa card people don't tell you who their insurance is for or who is excluded...They just sell it to you, take your money then load up your life with bullshit red tape answers while they run to commit more phone fraud...They also have sold to retired people (excluded), students (excluded), freelance workers (excluded), seasonal or part-time workers (excluded), disabed people (excluded)...They are totally full of shit & their letters below are just more shit compressed with vomit & verbal diarrhea...Makes one sick just to deal with them...

Update: Wed. June 13, 2012: Oh, yeah...& they SAY they sent me a written thing that supposedly told me all about the whole insurance policy...They SAY...But that is their word against mine...I never got a written insurance policy...Nor did my husband see it in the mail...This is TD Canada trust bank SAYING they sent me a written policy, but I didn't get it...They say they sent it, they say that they have a record of sending it, they say that they got no returned mail...This is all hearsay...They say...I say I didn't get a written policy...So...Who are you going to believe? A bank who is defrauding people using an insurance product that has been PROVEN to be a fraud worldwide already...Or a person who is out over 3 grand now plus $10,000.00 in estimated aggravated damages because of wasting so much time trying to get back that money...This bank, & all the other banks who sell creditor's group insurance are all a bunch of liars...So why should anyone believe them when they say they send out a written insurance policy...Nobody else seems to have seen this policy...A lawyer looked at the written thing which we finally got to see after

months & months of trying to get this refund back...This is how the lawyer described this thing: " OBFUSCATORY"...

For the record, we also never got a copy of the "phone contract" which they quote to us all the time...I heard this rambling piece of shit though...Not one mention of EXCLUSIONS was made...Still these fucking criminals insist that informed consent was reached...Informed consent? Really"...Omigosh our country is full of criminals...Terrorists really...They steal from you with a smile on their face...Now that banks have dumped all their senior employees who might have been honest, they are all left with minimum wage lackeys who have no ethic, no university degree, no experience, & most importantly of all, no INSURANCE LICENCE...

http://business.financialpost.com/2011/10/26/td-bank-exits-obsi/ Read this link about how TD Bank just exited from OBSI (ombudsman for banking services & Investments) because Td bank didn't like how clients were getting positive results...)Read my comment there too! Sari

The fact that a self-employed person was sold this policy without being told that I did not qualify to make a claim for the benefits I consider duplicitous...The fact that the solicitation was bundled with my card reactivation I also consider duplicitous...The fact that credit protection insurance is sold as negative option billing, meaning you have to cancel in order Not to have it I consider unfair business practice...The fact that I have found so many others online who have complained about being sold this while not qualifying because they are self-employed, disabled, students, retirees, seasonal workers, part time workers, or didn't hold a job when signing up, I consider indication of willful fraud on the part of TD..The Insurance Act indicates that if material facts of a policy are not disclosed by the insurer when selling an insurance policy, & it is indicative of fraud, then that contract should be voided & all monies returned to the client...I consider my case valid from this respect...Td has not given me a refund & their ombuds-processes have been remarkably defensive of what has been decided as being a fraudulent insurance product by the international insurance community at large- to such an extent that England has banned credit protection insurance in its entirety, & all Class Action lawsuits in the States have been won by consumers & monies refunded already, with more Class Actions beginning as we speak...I have discovered severe documentation about credit protection insurance online already, & it appears that it is only a matter of time before it is banned in Canada...As such, for now, I am still trying to get a refund & hope that you can help...

What follows are three recent letters I have sent complaining about credit protection insurance... 1)First letter: precedent: failure to disclose, TD bank, fraud... From: "Joseph & Sari Grove" <[email protected]> To: "Td Ombudsman" <[email protected]>, "Financial Consumer Agency of Canada" <info@fcac- acfc.gc.ca>, "FSCO" <[email protected]> Date: Tue, 25 Oct 2011 10:39 AM (8 hours 20 minutes ago) Hello, I am still trying to get a refund of $2,684.70 plus interest from TD Visa on Balance Protection Insurance... I am adding an excerpt from a previously decided case that applies to my own: The reason the client was given a full refund on all premiums taken for balance protection insurance is that the client was self-employed, like I am, (& that fact is clearly written on my credit card agreement...) At no time, in the over the phone conversation was I told that a self-employed person would Not qualify for the majority of the benefits of this policy...Had I known this, I most likely would NOT have agreed to this policy...In case precedents, it is not sufficient that a mention of exclusions exist buried in written documents, but that the fact that a self- employed person is Excluded from benefits be drawn to that person's attention when the policy is being sold over the phone... I consider it abhorrent that a policy excluding a self-employed person was sold to me & that I was not told of this exclusion over the phone when you signed me up...It is further abhorrent that TD Bank, TD Insurance, & TD Visa, does not admit they wrongfully sold a policy while failing to disclose material facts about the insurance, in such a way that can be deemed fraudulent... In many, many, documented cases, published online, clients are repeatedly shown to have been sold balance protection insurance, without ever being able to qualify to make a claim...These are the self-employed, the disabled, students, retired people, seasonal workers, part-time workers & the list goes on...The fact that so many people were not told that they would be excluded from making a future claim, indicates more than merely a failure to disclose on the part of the insurer, it indicates a willful act of lying by omission in a grand scheme, on a large scale, & where significant monies have been taken with unfair business practice from clients, in a manner consistent with large scale fraud... As such, I repeat my request for a full refund to my credit card... Sari Grove [email protected] 416-924-9725 grovecanada.ca

one of the excerpted examples of a self-employed person getting their refund: "In these circumstances, the financial business should have drawn the term to the attention of Mr D when providing information about the policy. The term was not highlighted in the policy summary – it simply referred Mr D to the longer policy document where the term could be found mid way through a 20-page document.

We did not consider that this gave the term sufficient prominence. We decided that if the term had been drawn to Mr D’s attention, he would probably not have taken out the policy. It was unlikely that he would be able to claim under the policy for the most likely cause of future unemployment.

We told the financial business to put Mr D in the position he would have been in, if he had not taken out the policy, by reconstructing his credit card account."

2)Second letter: Hello, here is an excerpt form the Insurance Act: "Non- disclosure by insurer 185. Where an insurer fails to disclose or misrepresents a fact material to the insurance, the contract is voidable by the insured, but, in the absence of fraud,..." Ok...But I am looking at voiding a contract in the case of fraud... In 2004, over the phone when activating a renewed TD Visa credit card, I am told I agreed to balance protection insurance... I write, I am told, because I have no recollection of the conversation... In fact I had no idea I was enrolled in this program... Nevertheless, I found out recently that $2,684.70 plus interest had been debited from my TD Visa credit card over the years... When I looked into what this policy was, I found out that self-employed people do not even qualify to make a claim... It appears that I am not alone, that, in fact, tens of thousands of Canadians who are self-employed,

disabled, retired, seasonal or part time workers & students have been paying millions of dollars a year total for balance protection insurance that they cannot ever qualify for to make a claim... I believe the lack of exclusionary questions in the telephone call are not merely failure to disclose facts material to this insurance, but in fact knowingly omitted in a manner more concurrent with large scale fraud on the part of the credit card companies selling balance protection insurance... In fact this balance protection insurance has already been deemed fraudulent in England & the United States, & Class Action suits in both countries have refunded all monies to consumers... But Canada is last to this legal party... I am reporting TD Insurance for insurance fraud related to balance protection insurance...For fraudulently selling this product to tens of thousands of Canadians, knowing those people could not ever make a claim...Knowing those people did not qualify for this insurance & on purpose omitting any exclusionary questions in order to exploit & profit from this fraudulent product... This is not a case of one person being misled by one insurance agent...This is a case of a calculated phone sales speech, designed to rope in as many people as possible, with no care if the person could benefit or not...It is so widespread & so much money has been taken from credit card holders, that it constitutes a

breach of law, insurance law, a breach of the Insurance Act & a breach of human decency... Please contact me by email or by phone at your leisure, sincerely Sari Grove

3)Third letter: From: Joseph & Sari Grove [mailto:[email protected]] Sent: October-24-11 6:39 PM To: Contact Centre Subject: Balance Protection Insurance... Hello,

TD Visa has taken $2,684.70 plus interest from me for something on my TD Visa called balance protection Insurance... I discovered a charge recently, & when I went to have it removed, they told me it was legitimate...

That is when I discovered the total amount of damage over the years... Apparently this balance protection insurance was sold to me in a phone conversation many years ago when I was re-activating a new credit card... Apparently they say they sent me something in writing, though I never received or read it if I did...

Honestly I was entirely unaware that I had this balance protection insurance at all... My husband checks my statements, & he did not catch the charges either... But even worse, I discovered that a self-employed person is not eligible to make a claim on balance protection insurance at all anyway...

When I discovered these unauthorized charges, I thought maybe I could swallow the mistake & just have TD Visa pay off my balance owing on my credit card & somehow that would make it square again... But self-employed people cannot make a claim???

So I was sold a policy in a coercive & deceptive manner, with no annual reminders to ask me if I wanted to renew (which would have at least told me I had this policy), for something that I was completely ineligible for...??? I am hitting a brick wall with TD Insurance, who apparently thinks that everything concerning the sale of this balance protection insurance is done correctly... How can someone sell you insurance if you can never make a claim for it? How is this legal? I am so shocked... I am also depressed at the state of corruption that a bank of this stature can stand behind so obviously a corrupt product... Not only would I like my monies back, but I'd like to see TD Insurance penalized for their unfair business practices... I'd also like to see this whole balance protection insurance banned as a product in Canada in its entirety... Do you agree? If so, can you help in any way shape or form?

I have jumped through the appropriate hoops of talking with TD, & have gotten nowhere... The profits from this unscrupulous device are obviously so great as to have clouded their judgement...

My husband comes from a military family & all our extra money goes to them...That money taken by TD has being taken away from people who really need it... But worse, it has been taken in an illegal way & legislation needs to be enforced against TD...

There doesn't even appear to be any certified insurance agents selling this thing nor administering it, nor even any of the people that I have dealt with... How can non-certified people sell insurance products in Ontario? There needs to be laws about that too...

Any help you can give is appreciated, Sari Grove GroveCanada.ca groveontario.wordpress.com [email protected]

416-924-9725 Notes: I became aware of unauthorized charges on my TD Visa credit card only recently...It was just the end of August this year 2011, that my husband saw the charge & we both had no idea what it was for...This was because we hadn't made any new purchases on the card in a long time (2 years maybe?), & yet there was this new charge...because the statement was bare except for this charge, we were able to notice it...Balance protection ins. on your credit card statement is very hard to spot, since it only appears if you carry a balance, but if you are carrying a balance it gets buried in the pile & looks like a bank statement fee or an annual credit card fee...Online complaints from other consumers indicate that a high percentage do not even know they have this insurance product at all, for many many years- which indicates that this product is designed to be hidden on purpose... Name of most recent person at Td Insurance who sent me a letter: Michael Brunette wrote the most recent final position letter...no email address was given...no phone number was given... brief details of steps taken to date in order to try & resolve this matter: 1)Called TD Visa to have unauthorized charges removed 2)Was told the charges were for credit protection insurance...Said I didn't sign up for it & asked for an investigation...Cancelled whatever this thing was immediately... 3)read about credit protection insurance online, CBC Marketplace did a documentary viewable online warning that this was a scam...Discovered that self- employed person could never have qualified anyways... 4)Was told there was a phone record of me saying yes to this... 5)wrote letters to TD Bank, Easyline phone service who does the phone sales for TD, Visa, Insurance, saying a phone record was not a contract... 6)wrote letters to above saying self-employed people do not qualify, so why was I sold this? Included the fact that my credit card agreement with TD Visa states clearly that I am self-employed... 7)wrote to the FCAC to have them investigate TD Insurance for unfair business practices & asked for a 250K penalty to be applied to them... 8)wrote to the underwriter

Assurant Solutions/ABLAC to see if they could help 9)Spoke to the ombudsman for GIO about this matter & advice 10)spoke to two lawyers, but did not retain them yet... 11) wrote to class action lawyers concerning a possible class action lawsuit, did not retain them yet... 12) went through the TD bank ombudsman, & though they referred me to the TD Insurance ombudsman, the insurance ombudsman said this was a matter for the TD bank ombudsman...The runaround...

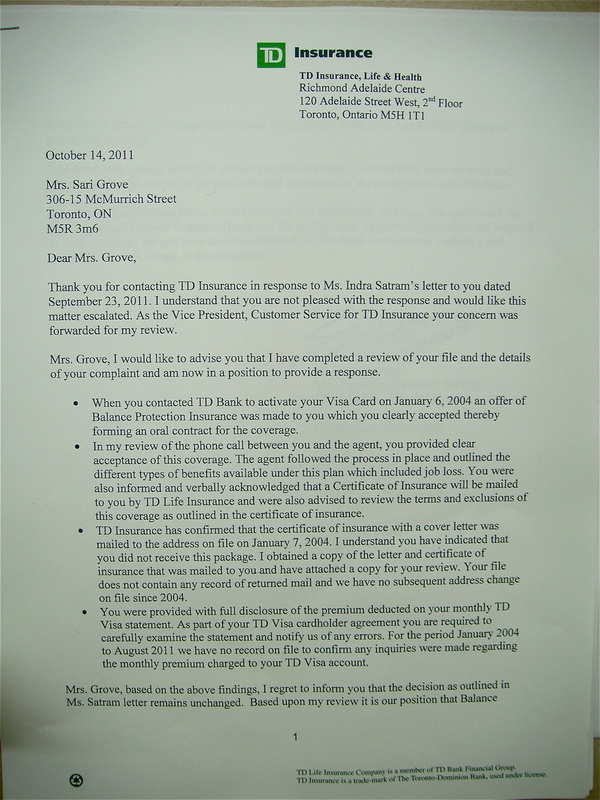

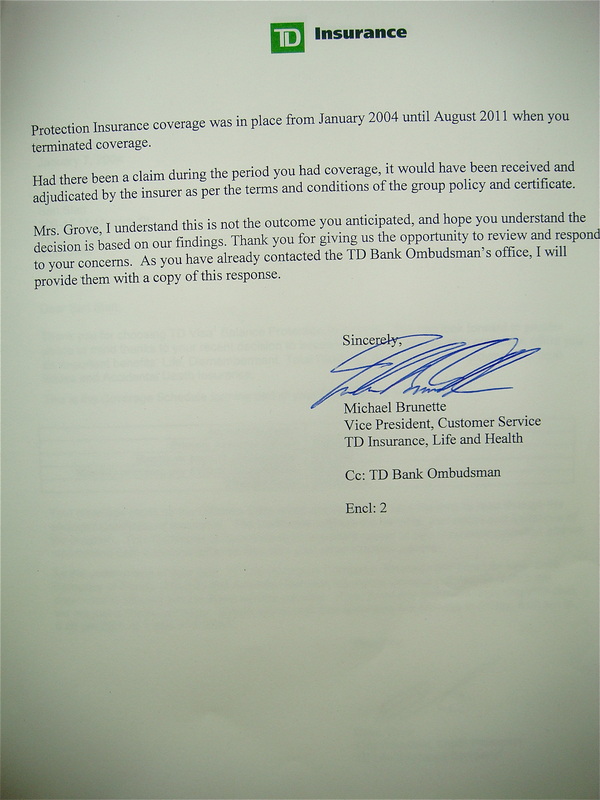

13)received rude final letters, one from Indra Satram, one from Michael Brunette, which just repeated like a template that they were not going to give me my money back with no apparent intellectual listening to the facts of the case...Form letters basically copied & pasted from a template is what I got...

14)Spoke to a branch manager in person at TD bank at Bay & Bloor, who made some calls & also found herself stymied by runaround, delays & lack of authority in finding a person who would take responsibility... 15)Wrote to FSCO, & was told to fill out a complaints form... 16) Published all my writings on this subject on my blogs & websites & Twitter & my Facebook business page & received an email from a lady who thanked me for publishing this information, & who got a refund soon after because her son had been signed up for credit protection insurance, but he was a student...Apparently the fact that he was a student & could not qualify for credit protection insurance claims was sufficient for the mother to get a refund immediately for her son...I question why TD Insurance has not given me a refund based on the same exclusionary fact- namely that I am & have always been self-employed... 17) Some of these steps are not necessarily in the correct order...I have probably spoken & written to more organizations & people than I have noted above...The Consumer Protection agency of Ontario also helped me over the phone... * Have you completed resolution process at your firm? (Help) Yes (Yes) * Have you started legal proceedings? (Help) No (No) Additional information How did you hear about OBSI? We were referred from another organization online, here is the link- http://www.canadianlawsite.ca/consumer-protection.htm#d If you have completed the complaint resolution process at your firm, please mail or fax us that letter along with any other supporting documentation. (OBSI Address above) Submit © Copyright 2006 OBSI All rights reserved

RSS Feed

RSS Feed