The incidental exemption, or enrolling activity by the banks, is actually quite massive...

Estimates are 2 million dollars a year per bank to administer, with a 20 million dollar profit per year...

This is for the incidental enrolling...

So the banks ARE selling insurance...

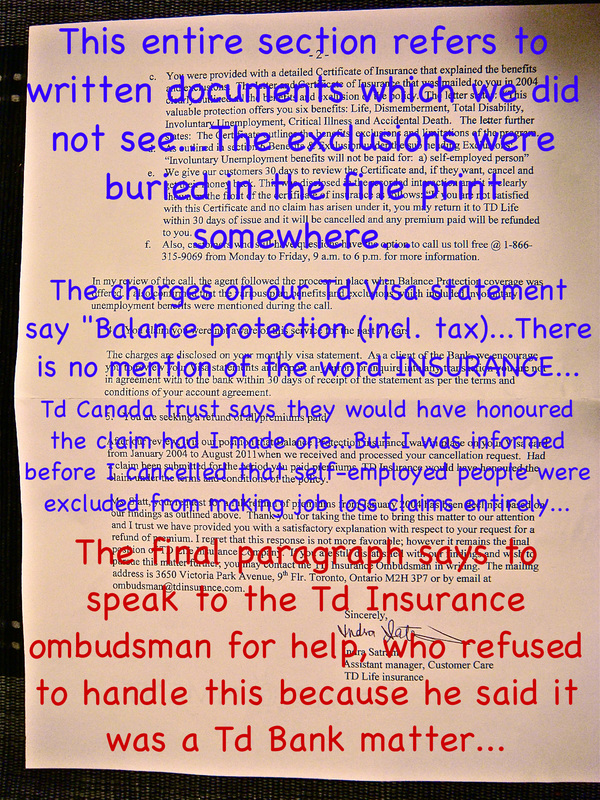

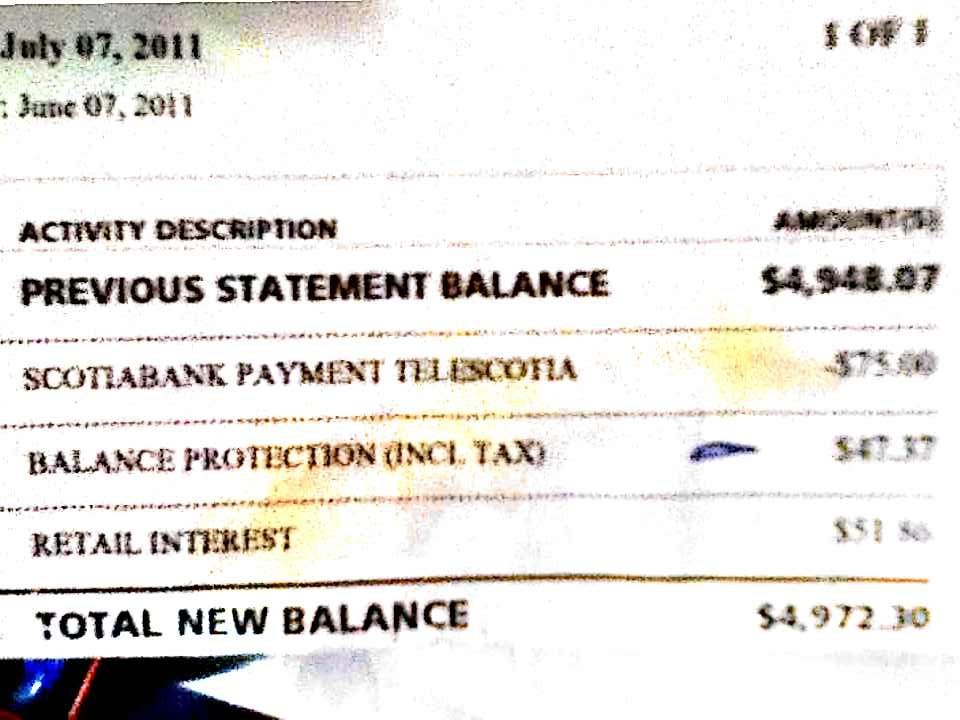

That little afterthought exemption took $3,000.00 dollars out of my pocket...During the worst decade of my self-employed business life...

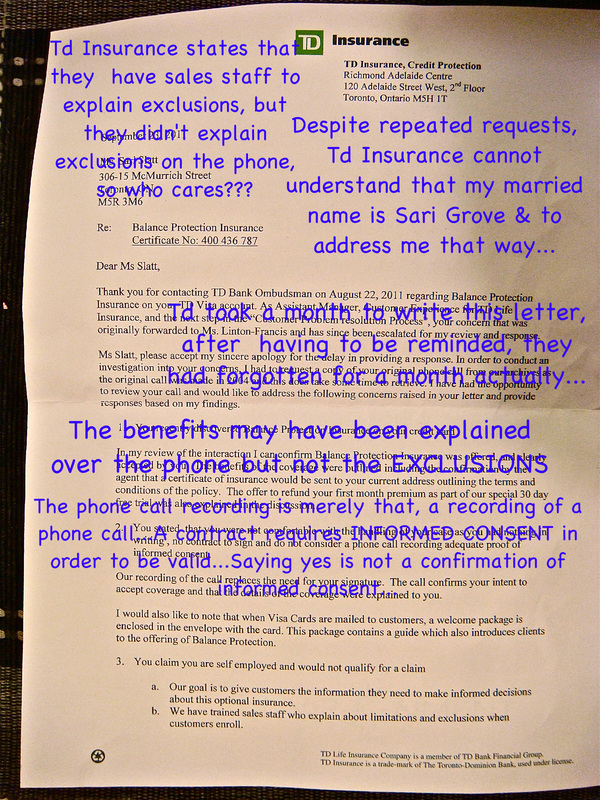

There are probably tens of thousands of people like myself in Canada who were missold this exempted insurance by the bank, over the phone...

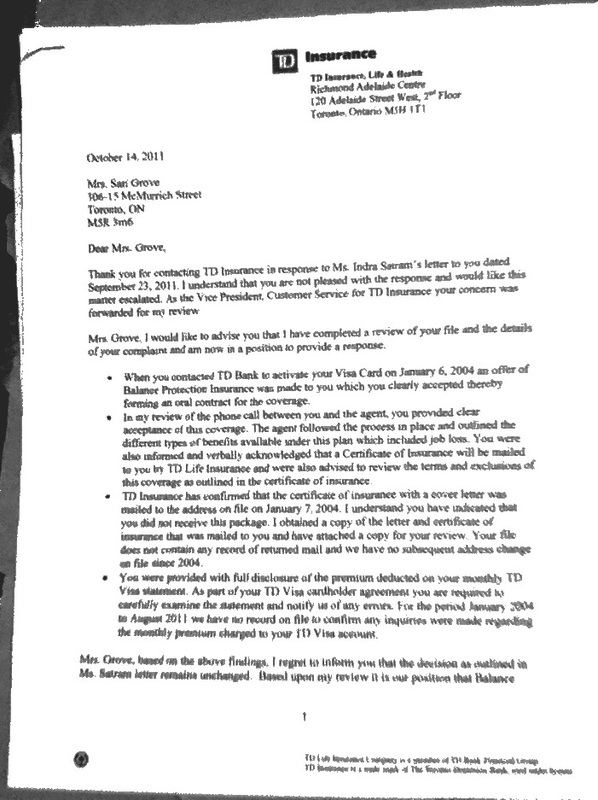

Once you say yes over the phone, the money is automatically taken from your credit card without another word or any signed confirmation at all...

Statistics on insurance state quite factually that in insurance "enrollment", the vast majority, over 90 per cent, of people who say yes to an insurance policy over the phone, do not or are not able to read or thoroughly understand/comprehend any written documentation that may or may not appear 10 days later in the mail...People who can say yes over the phone are not necessarily qualified to read or give informed consent to complicated & obfuscatory written insurance policies...

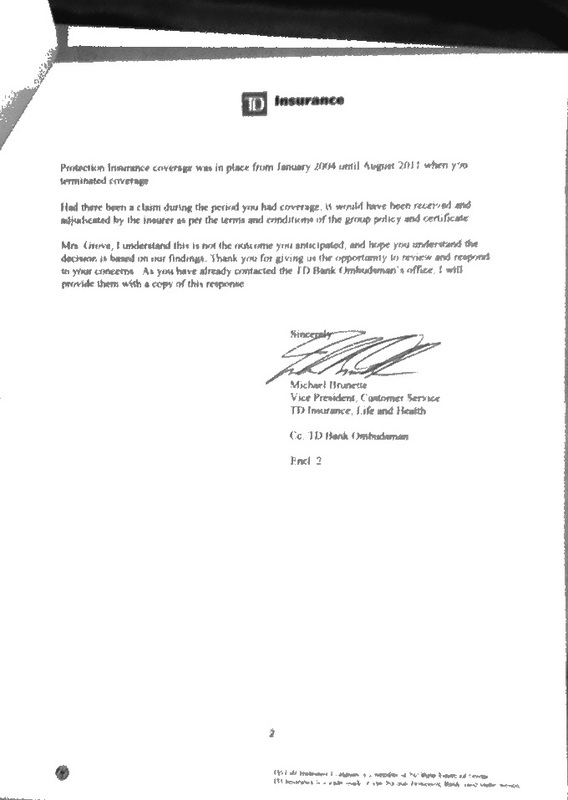

I have been through the entire ombudsprocess with the agencies mentioned...I have also attempted to use other intervention with other agencies not mentioned below...

The insurance industry is making HUGE money on balance protection insurance...

As are the banks...

Which is why I have not gotten my money back yet...They don't want to give it back...Even though they know that it is wrong...

They all know they have taken money wrongly...But they are hurting too, so they have turned a blind eye...

I have been in touch with a major Class Action law firm here in Canada...

They are looking into a Class Action lawsuit against all the banks in Canada who have sold balance protection insurance...

In The States & England this has happened already & ALL people sold a policy by a bank are getting a refund...ALL...ALL people who have EVER been sold a policy on a credit card by a bank...

That is how bad this is...

Canada is the last country to correct this wrong...

It should be our government who initiates this action...Not a law firm...

But our government has been slow to act, because they are in bed with the banks...

The answers below sound good don't they?

But they are meaningless when one person attempts to jump through those hoops...

The incidental exemption is key...

Legislation is only regulating licensed insurers...

Nothing about the banks...

That is the loophole...It is a giant black hole loophole...

Sincerely, Sari Grove

grovecanada.ca

RSS Feed

RSS Feed