A horse is born in an amniotic sac...A raccoon...A bird...But you say: "Why is the bird's amniotic sac so thick & heavy & impenetrable & white?"...because it must be...Albumen is not enough..You must include the egg shell in the counting of the amniotic sac of the bird...The bird's nest must not be disturbed, no matter where it is put... http://lists.goantiques.com/archive.php?u=5caf560a218d4d9dc9f4483f93bef28d&m=554 Worthpoint Antiques newsletter, an excellent edition...I discovered a Louise Bourgeois inspired spider tea leaf steeper at Birks on Bloor east of Bay, with my mum...It was a metal thing shiny designed by a designer, with spindly spider legs & a sieve type cup in the middle elliptical place where the spider's body & head would have been...About $45-$60 dollars Canadian currency...I didn't buy it nor make my mum buy it, but I did look up the designer online & found a slightly cheaper version online at Worthpoint Antiques, albeit not quite as shiny & new looking as the Birks model...It was described as an Art Deco style which I agree with...1920s feel, as is the spider at the NGA National Gallery of Canada in Ottawa...We have a spider who has lived under our deck for over 40 years now...She is quite big now...I did a design for Swatch in Switzerland including my friend the spider...(When I say I did a design, I mean I submitted a design to a Swatch competition...) Later, Louise Bourgeois came out with her giant spider sculpture...I am alright with that...Inspired by I like...Copying no... On another subject: The Roman Catholic Church rescinded its take on hypnosis around 1985, meaning it no longer endorses hypnosis even for the particular use of anaesthesia...The AMA American Medical Association rescinded also in 1987...Which means that it is no longer legal in Canada to use hypnosis...Not for licit purposes...Not for anaesthesia...Not for the serious... The use of drugs to increase suggestibility is also a combine of illegal drugs & illegal hypnosis...Two counts of crime... The "on purpose" killing of wildlife, which includes rats, squirrels, raccoons, is a prosecutable offence in the Ministry...The use of strychnine is indication of intent...The coverup by smashing with a car grill is indication of complicity by an accomplice... A school board who orders a pest control service to kill wildlife is at fault...For ignorance, stupidity & lack of literacy...Not to mention cruelty to animals... 3 raccoons, 2 squirrels, 1 dog, several children, a semi-disabled adult, have all already ingested the airborne rat poison put out by the pest control assholes...May pest control rot in their own special hell...p.s. 2 large rats, & several pigeons...(hit by construction machines after being poisoned by white powder anticoagulating rat poison, becoming disoriented & walking through the street...)

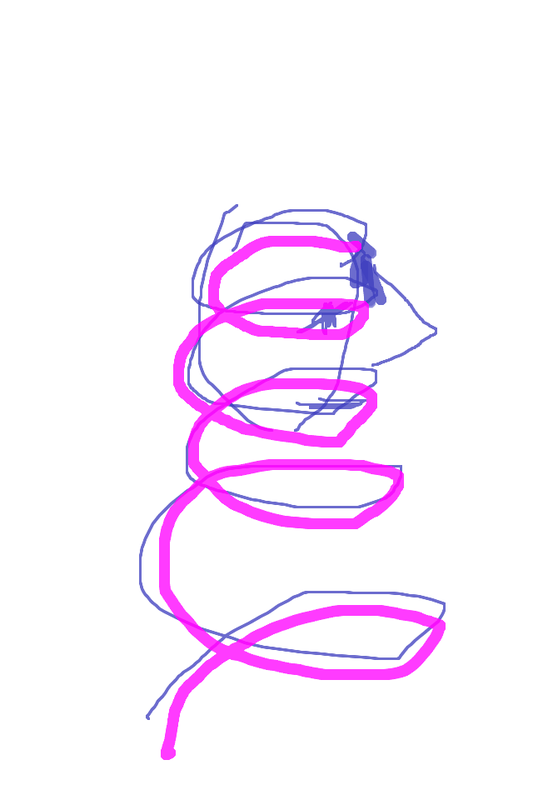

When or if you get hit in the forehead: The concussion is like a big bruise...The wound travels in a downward spiral, like a Fibonacci spiral...It starts at the front & moves to YOUR LEFT, & continues along the back of your head in the spiral...So the bruise/concussion moves...& that is how it moves...Expect to find the wound from the front of your forehead/head, at the back of your head & lower, ten years after being hit in the front of the head...The spiral is an eternal flow of nature... Polio: cause: aluminum/potassium dominance in lymph nodes remedy: titanium dioxide topical wash soap product: I like Punch Studios lemon soap from Marshalls' with titanium dioxide inside method: rub soap under armpits & other places around your lungs too, rinse, repeat Muscular Dystrophy: a disease of sorts brownies: an addiction in young ones who like birthday parties kidneys: a place in your body where brownies live Celiac: a thing that refers to a condition where the glutens in the brownies gather in your kidneys & make your right foot crampy...(related to MD Muscular Dystrophy insofar as celiac may be an early indication of brownie addiction...)(in very young children, kidneys blocked with brownies- ie: the parents'- may have passed on to the young the brownie blocked kidney...) Marigold, Aluminum, Potassium, Styptic pencil, cut/marks in skin coagulators/healers/antibiotics like Vodka (heals cuts in skin)... aspirin, marijuana, titanium dioxide(occurs in expensive soaps like Punch Studios lemon soap at Winners/Marshalls & SPFs like ROC spf60), cocaine (coca leaves are safer), chat (The Somali drug they brush their teeth with- it is also a green chewable plant). anti-coahulators... Involvement: Lymph Nodes Relation: Tuberculosis adjunct: magnesium epsom salt baths to lower mercury levels in the gallbladder & to clean lungs... herpetic/shingle: selenite/selenium/garlic therapy eat raw cloves with yogurt to lower blood sugars in the pancreas thereby avoiding or preventing or correcting diabetes... Barley grass powder to regrow & correct neural tube damage in the renals/kidneys if rupture has occurred or to prevent (& repair)... (tiny amounts in juice is nice)Tequila/Agave repairs ruptured tendons/tendonitis (caused from winter running)...Synchronize with red meat for "cross" effect...(tequila crosses with red meat to rebuild tendon...) If Cerebral Palsy is related to the right kidney failing then Muscular Dystrophy is related to the left kidney failing...When I say/write left or right, I refer to YOUR right or YOUR left... Pneumonia related to diabetes & antibiotics- lower sugars intake by switching to artificial sweeteners... http://www.donaldcurrie.com/products/bio/ Toronto Dominion Canada Trust Bank uses evil hypnotist Donald Currie, son of an evil hypnotist (another Currie), & sometime "banker", to call people & get them hypnotized into vaguely agreeing to credit balance insurance on their Td Visa credit card, thereby bilking them out of thousands of dollars in unnecessary insurance...How many other banks in Canada use son Donald Currie's services in banking to hypnotize unwilling phone customers into 20 million dollars a year in bank revenue (& it only costs the banks (like Easyline TD Canada trust's phone service) 2 million dollars a year to administer in evil hypnotist fees? (I type the word evil lest you think that hypnotism is good, or not a practice of the occult & an enemy to God...)In other news: carbon may be the culprit in Down's Syndrome...Carbon is a fat related molecule that can be ridded by ACV(apple cider vinegar) type things...Think coal miner's lung...Think ACV to clean that out...Carbon is sticky & airborne which is why ACV is needed to clean it out...Boiled hot water with a fresh lemon squeezed in after, is useful for washing coffee out of the mouth & whitening teeth...Rumours...

New Nickelback album Here & Now for free on Itunes now, supposedly... Crohn's disease(an Opposite to Downs Syndrome) : Haggis, colon...Characterized by Excess Titanium in Lymph nodes, which can be offset by wearing Aluminum anti-perspirant which blocks leaky lymphs... Pumpkin, sweet potato fries: stop up diarrhea If Down's Syndrome is black sticky coal miner's lung lymph node carbon potassium aluminum Coagulating excess dominance, THEN, the Titanium ANTI-Coagulant characteristics of Apple Cider Vinegar(shampoo?) should remove that excess or dominance... afterthoughts but not loserthoughts:(tequila plus beer remedy for hemorrhoids* chicken wings have cartilage) (melon orange bite into hold as bite plate/tooth whitener *hold) (hepatitis don't make marks in your skin chopped liver remedy) *TAKE: strychnine titanium soap fresh air *cleanspluschlorine magnesium water epsom salts* cleans refreshesplusbaking powder fat carbon charcoal woodEquals Homemade= equals homemade cocaineEpi-pen:Ok, a peanut allergy is excess manganese in the thymusiron is the corollary or opposite to manganesemanganese is NOT the same as magnesium btwThe Thymus is NOT the same as the thyroid glandpesticides are made of nicotine or zincnicotine or zinc is the corollary or opposite to leadlead & zinc live in the THYROID glandMS or multiple sclerosis is too much leadpeanuts are grown in nicotine zinc to keep bugs offbugs contain protein or B12B12 is found in Baltic amber beadsiron & B12 are very close to each otheranemia is a deficit of iron or an excess of manganeseanemia affects the thymus glandan epi-pen contains caffeine which contains ironinjecting iron into an anemic person is a good thinga bee injects iron too but naturallya wasp injects iron too & doesn't die after the injectiona fly does not really inject but just visits you & deposits iron...Bugs are your friends...A spider can inject iron venom too...That is a good thing if you are anemic...Peanut butter which contains manganese can be dangerous to an anemic person, because by raising manganese levels in the thymus, you lower iron levels...get it???People with Down's Syndrome should drink a little bit of vinegar in water daily...This will remove the carbon molecule fat from their lungs, slowly...(carbon is like charcoal or coal)...Vinegar is the opposite of carbon...Carbon & fat are similar...Fat is a blocker...Vinegar is an enabler (in a good way)...People with Crohn's disease should not drink vinegar...People with Crohn's disease should eat haggis, go to Scotland, or adopt sheep...People with Crohn's disease should use charcoal to barbeque...People with Crohn's disease are LOW in fat in their lungs...(The colon is merely a passageway btw)...(btw stands for by the way btw)...

Birds

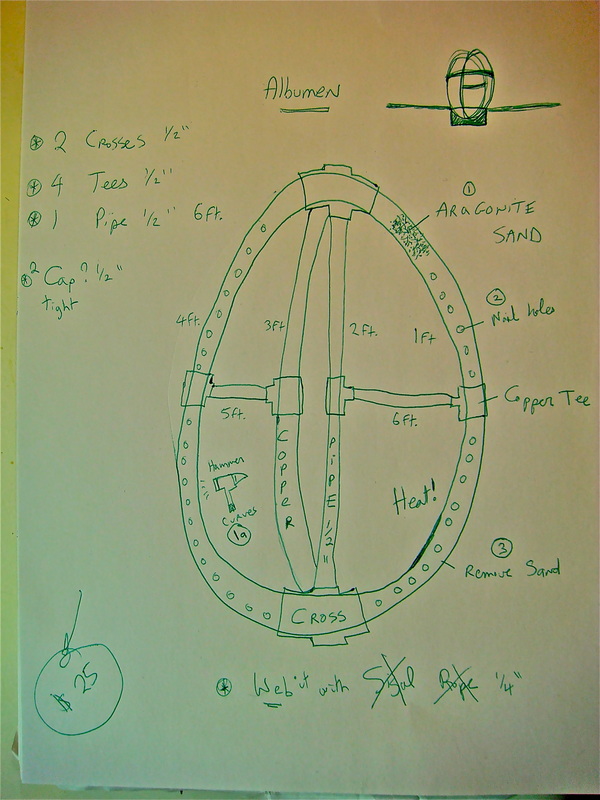

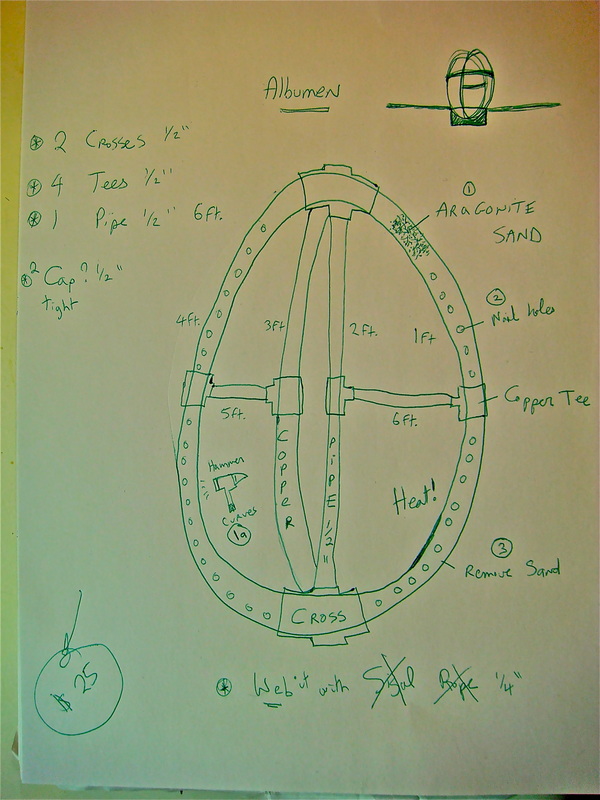

My ferrocement mix is 2 parts white portland cement to 1 part aggregate. that aggregate consists of alkaline resistant glass fibres 3/4 inch size, perlite, white silica sand & natural aragonite sand. to that I add 1 part liquid which consists of cement bond admixture at 25% to 75% water. colour is powdered cement paint added to the whole mix. My eco-friendly no voc no volatile organic compound concrete sealer is 1part rainsil to 9 parts primasil. I source from kreitmaker, sutton garden & buiding supply, home hardware, home depot, sculpture supply studio, eco-house, & canadian tire http://www.bunburyfilms.com/films/trailer/doc/wip.html

Excellent Movie trailer above:Men's Baltic Amber necklace on Etsy.com : This contains B12 which will slow down a 'speeding bipolar manic-depressive nutty delusional manganese high thymus gland' (in a nicer way than lead based lithium type anti-epileptic/anti-psychotics which act on the thyroid by lowering zinc levels...) This information is for a guy out there who may want to go off his meds...You Need an alternative & wearing a necklace all the time is less painful than nothing at all...Really...

A little story:

Real Estate: A guy sells his house for $450K...Another guy goes to the bank to borrow the $450K to buy the first guy's house...The guy who goes to borrow the $450K from the bank lies about his income in the "stated income" spot on the application form...A third guy, the loan officer approves the loan at the $450K for the house...

Seller takes the $450K & runs with it...Guy moves into the house, makes payments for 2 years, then lets the bank foreclose on the house...Guy who bought house actually makes $25K a year income...Payments for the two years to the bank equal say $75K before the buyer of the house defaults on his mortgage...When bank forecloses on the house, it is discovered that the true appraised value of the house is only 250K, 200K less than what the bank paid out when the house was bought...Say bank sells the house at $250K, the bank has lost exactly $200K on that, minus the $75K the guy paid into the mortgage before defaulting...

So the bank has lost $125K total...Where did that money go? Well, let's say the seller guy, the buyer guy, & the loan officer were all in cahoots, & so they split that money three ways...What's $125K divided by 3? About 40 grand each...Actually, it is $41.666 K ...each... The real estate broker doesn't care because they make their money by elevating the price off the top & taking their commission, so the house probably went for over $500K or so to pay the broker...Now if you add a fourth person, the broker, the per house take is smaller of course, per person...If one of those guys was innocent, the per house per person take is more...

Take your pick...That is how the banks got bankrupted...

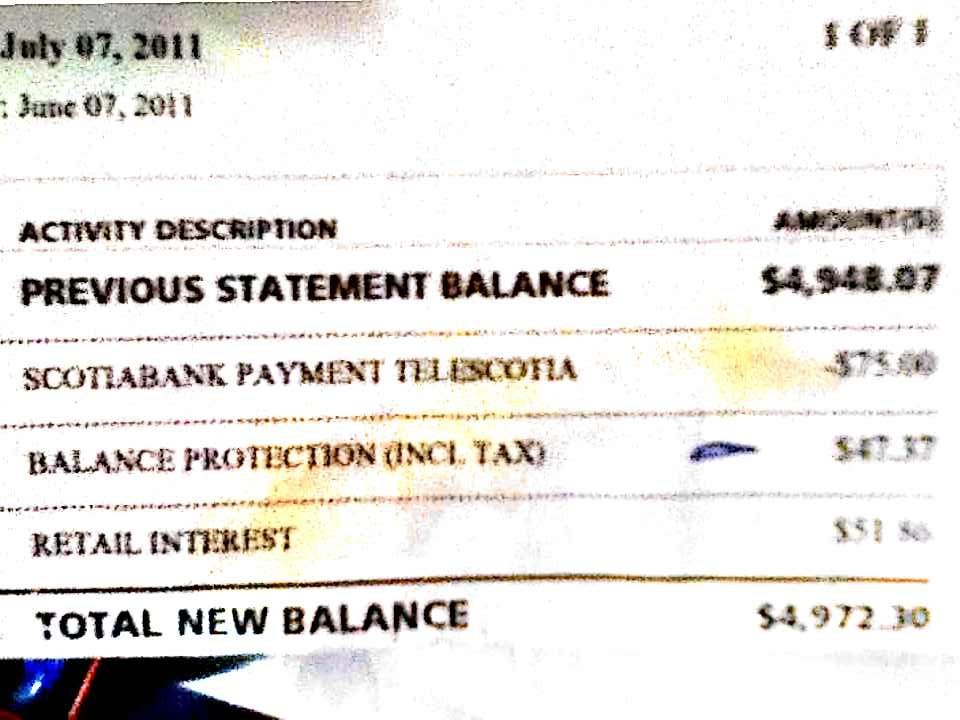

BTW, for the first 2 & 1/2 years after Td Visa signed me up for credit protection insurance (misnamed balance protection by TD), I didn't carry a balance, so really had no idea this thing was there at all...(it only shows on statements if you carry)...

http://www.millsandmills.ca/lawyers/MacDonald-Raymond-Toronto-lawyer.html Legal Shield PPL

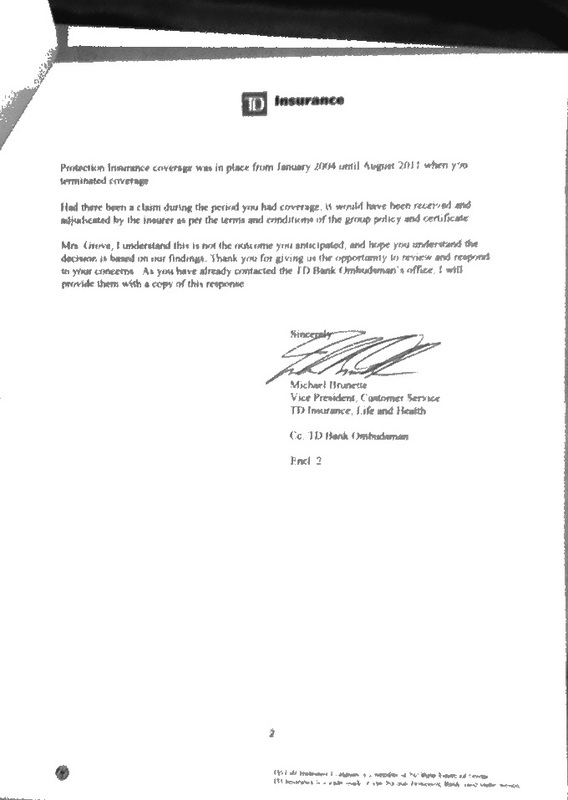

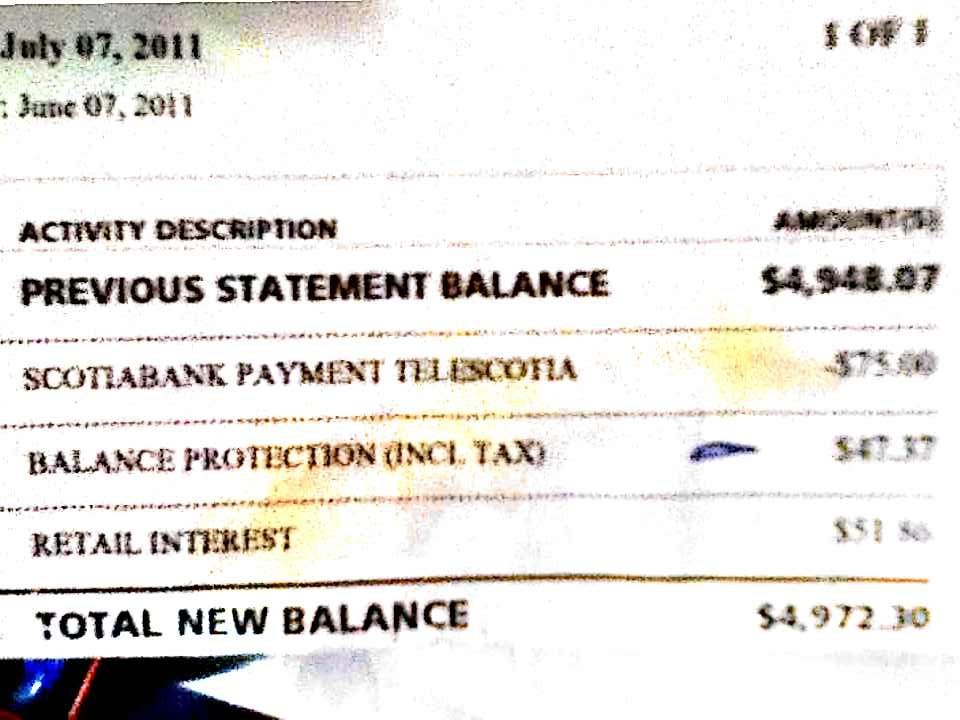

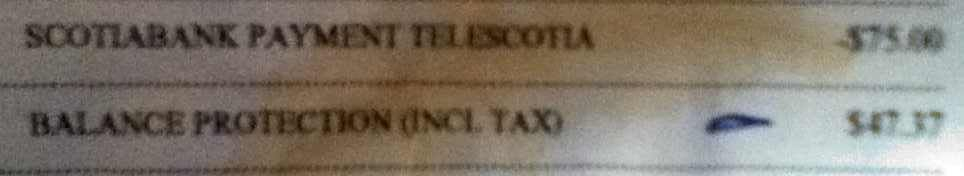

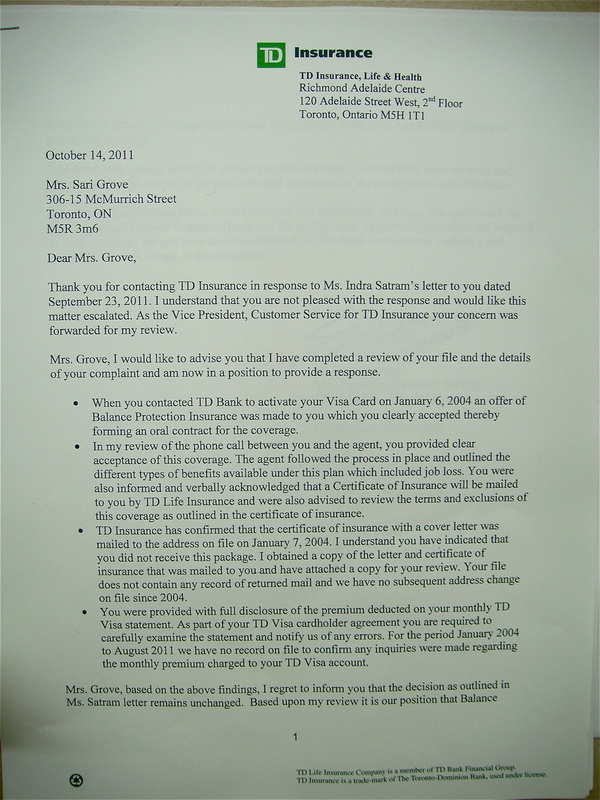

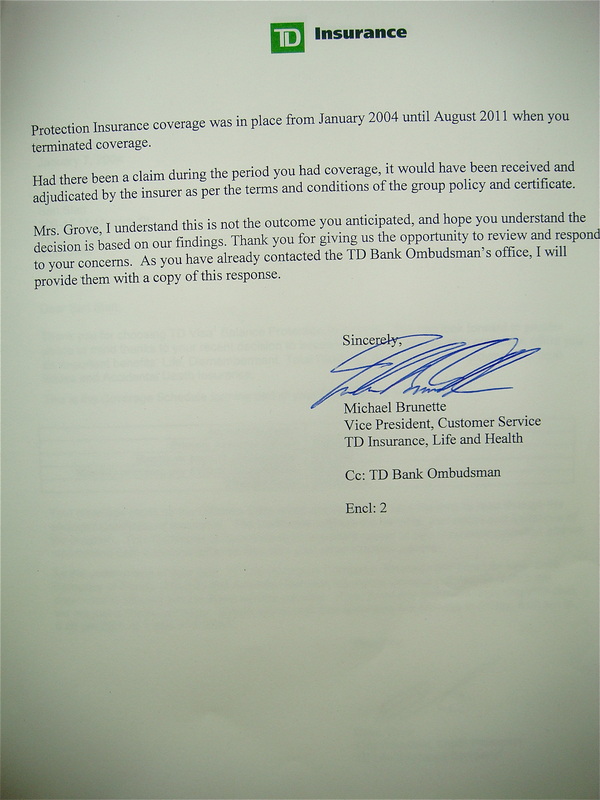

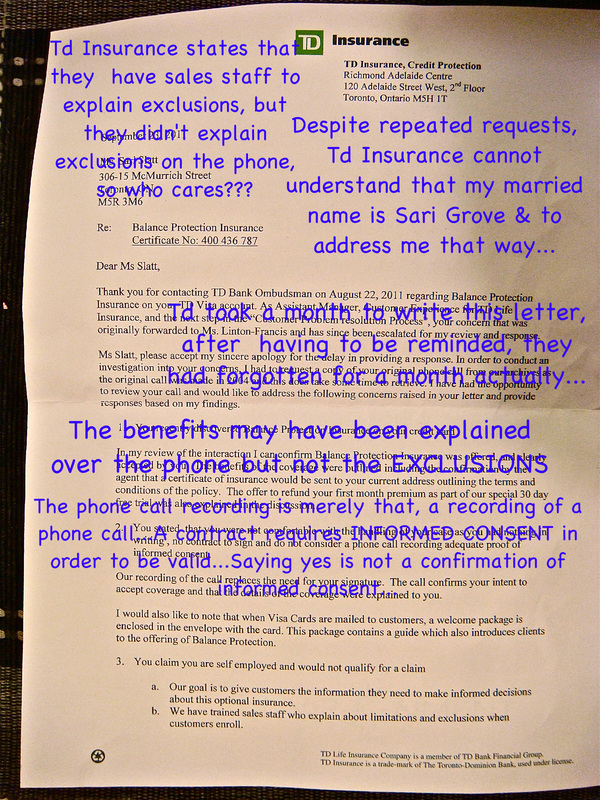

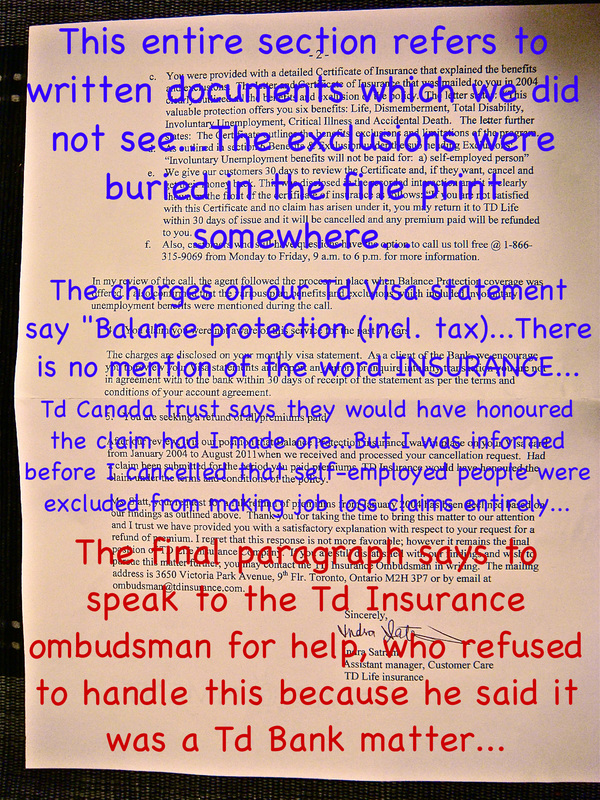

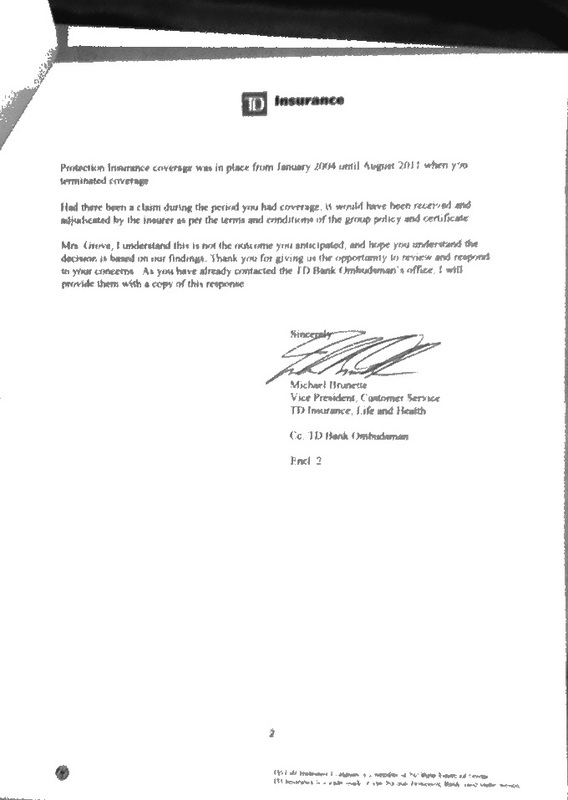

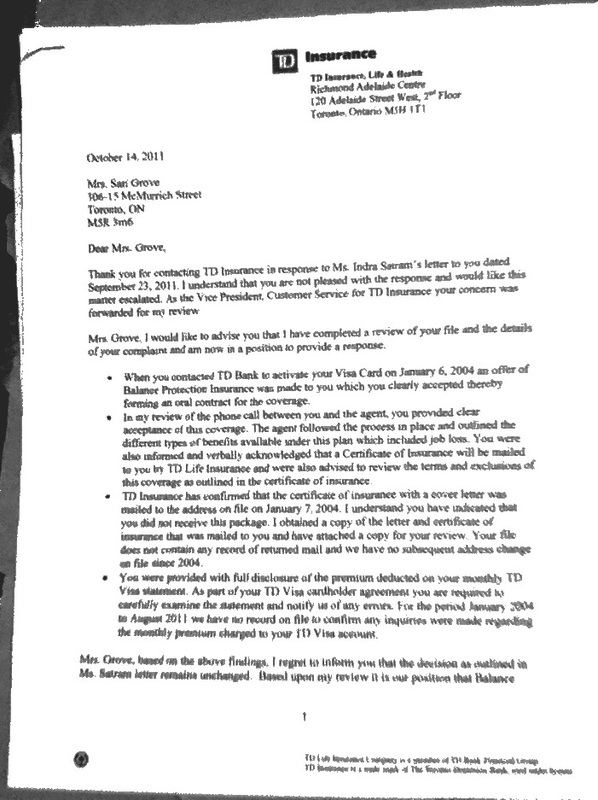

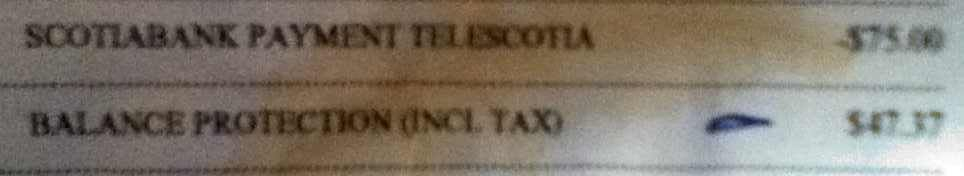

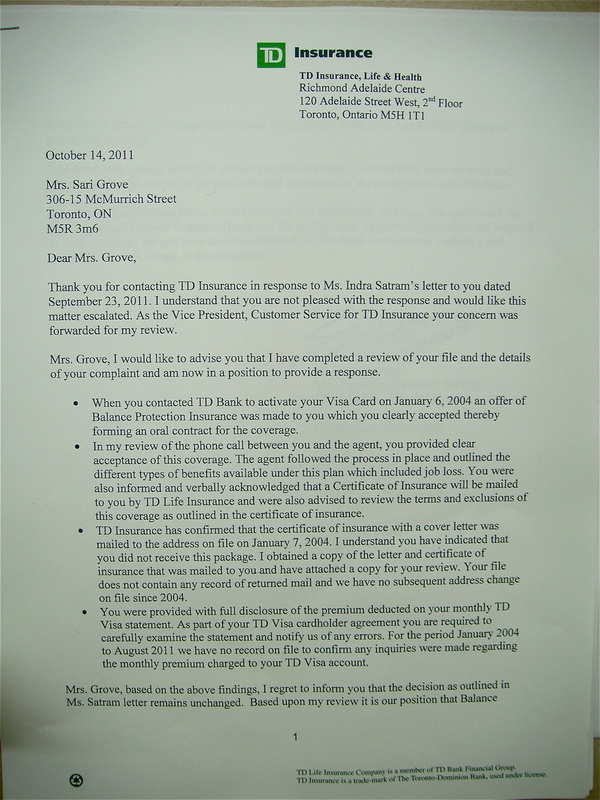

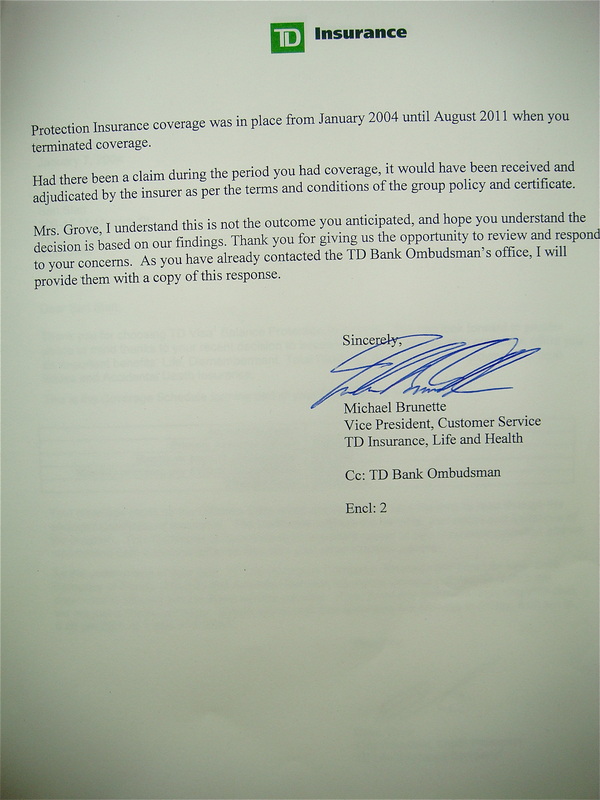

The pictures below are hard to read...What else would you expect from a bank or insurance company who you are suing? That's ok...read the captions under the pictures which explain where Td bank & Td Insurance are wrong...The product in question is a large group insurance policy, bought from an underwriter, converted into tiny little chunks, then sold by the bank through their credit card activation services when you call to activate a credit card...It is called balance protection & it is illegal in Canada in so many different ways, I don't even know where to start...  Notice if you can read the words "group policy"... This indicates Td Insurance took a group policy, split it up, & individuals were charged individual policy rates which are much higher...This is illegal by the way...  The first comment states that clearly accepting an insurance policy forms an oral contract...That is not true...A policy can be accepted by the client without INFORMED CONSENT being established...Just because you said yes doesn't mean that the legal requirement for informed consent was reached which is written into the Canadian Federal Insurance Act... 2)The second comment states that all benefits were outlined to the client...However, EXCLUSIONS were not mentioned in the "oral contract"... 3)The third comment merely states that TD Insurance SENT the written documents...There is no record of the client RECEIVING the written documents... 4) The last comment states that the insurance was written on the client's credit card statements from Td Visa...But in the next picture one can see that word INSURANCE does not appear on the statements at all...merely the words "balance protection (incl. tax)" which could mean any bank or credit card fee...  Ok, so here's the statement from Td Visa credit card July 07,2011 where we first caught the unauthorized charges...We pay From Scotiabank, not to...That thing that says Balance Protection (Incl. Tax) is insurance that a self-employed person cannot qualify for to make a claim...I was sold this without them telling me at the time of sale that a self-employed person is excluded...Would you have caught this charge? They asked me how I didn't see the charge, in an accusatory manner...My answer: Do you really think I wanted to pay , to over pay my credit card bill from month to month, for years & years, for something I could not use???? For the record, maybe if they had written the word INSURANCE on the statement I might have seen it or known what exactly it was...WE thought it was a banking fee...I guess it was a banking fee...Essentially it doubles the bank's revenue...Without the bank having to do much of anything...Liars...  $75.00 Paid down to TD Visa... $47.37 of that goes to Balance Protection that a self-employed person cannot make a claim for... Seems a little much doesn't it...? People who have said no to a refund so far in writing: Indra Satram associate manager TD Insurance, Michael Castonguay underwriter for Td Insurance from Assurant Solutions/ABLAC/American Bankers Assurance Company of Florida, Michael Brunette vp customer service Td Insurance...The first on paper, the second by email, the third on paper...Not in that order... It's a JOKE: Step 1:Embezzlement: First, embezzle money from credit card or bank account of customer, by selling them credit insurance or credit card insurance or loan insurance that they don't need, can't use, can't make a claim for, & are excluded from in the fine print that they can't read & make sure not to tell them on the phone when you are soliciting...(this is called embezzling in plain view, like someone stealing your stuff right while you are watching, it is a mugging of sorts)... Step 2: Breach contract with client by not fulfilling any claims that they make when they make a claim...Make up exclusions as you go along...Make up excuses not to fulfill claims as you go along...Point to the fine print of something they never saw...tell client how stupid client is repeatedly for not knowing they were excluded...When questioned, cry that the client is belligerent & hang up the phone or cease all communications...Give client runaround so they give up trying to get their money back...Stall...Stall until statute of limitations runs out & client can't sue... Step 3: If you absolutely must give money back, but you have already sent it to your terrorist friends who are already in jail, then kite the money from the account of a relative of the client...Thereby screwing the relative of the client & giving you more satisfaction... Conclusion: This is the experience I have had with Td Bank so far...The scam product is called Balance Protection...(Credit protection insurance is the legal term, but why would they use a legal term?) http://www.maclennanlaw.com/Thank-You.shtml

TD Visa sold me balance protection insurance without telling me over the phone that self-employed people were excluded...I found out self-employed people were excluded 7 years later...I bought the policy under the assumption that it would cover me in the event that I could not pay my credit card balance...They told me the oral contract in the over the phone conversation is binding...But in that over the phone conversation they did not state any exclusions for the insurance policy...I consider the fact that a self-employed person cannot make a claim to be a breach of contract...I would never have said yes to something that I was pre-excluded from...According to the phone recording, since no exclusions were mentioned concerning self-employed people, I consider that the contract covered me, a self-employed person...Either this is breach of contract, or void abinitio (void abinitio means void from the beginning & rescission must be made...rescission means all monies returned to client as if false contract had not happened......Either way I want my money back...$2,684.70 plus interest...There are others who have been sold this credit protection insurance too who also thought they were covered, & were not told otherwise at the time over the phone of saying yes...Again, breach of contract or void abinitio, void from the beginning, any way you slice it, everybody sold this balance protection insurance deserves their money back...This is either small claims court for just me, or Class Action lawsuit for all the others...Not sure of best course of action, please advise...Sari Grove http://www.mcsweeneys.net/articles/could-it-be-that-the-best-chance-to-save-a-young-family-from-foreclosure-is-a-28-year-old-pakistani-american-playright-slash-attorney-who-learned-bankruptcy-law-on-the-internetComments GroveOntario11/12/2011 12:06:00 In Canada, for example, the Criminal Code defines breach of trust as: "Every one who, being a trustee of anything for the use or benefit, whether in whole or in part, of another person, or for a public or charitable purpose, converts, with intent to defraud and in contravention of his trust, that thing or any part of it to a use that is not authorized by the trust is guilty of an indictable offence and liable to imprisonment for a term not exceeding fourteen years." In the case of a bank taking funds from a client's credit card, & using that money to help convicted terrorists who are already in prison in another country; that would be an example of breach of trust... GroveToronto11/12/2011 12:08:58 Those people who sold houses for exorbitant prices after 9/11 happened, & then left the United States...With the money...Would those people not be the terrorist's families themselves? GroveCanada11/12/2011 12:33:37 In fact, a telephone recording of a conversation about credit card insurance omits the recording of the customer typing in or activating their credit card itself...The fact that this part of the recording is omitted indicates a knowledge that tied in selling is illegal in Canada & the rest of the world... Sari11/12/2011 16:07:46 An insurance policy that disqualifies self-employed people from taking benefits is by nature discriminatory in a negative way...

B'Elanna & Jadzia...Bengal cats...Different litters...Born Dec. 1, 2004...Born April 16, 2005...Intact...Ladies...Silver, Gold...Our friends...Art Assistants...Family...Nicknames, Tornado & Munchkin...Scratches, Bites...Both get baths, like water...Can play fetch...Talk...B'Elanna is Mummy's girl, Jadzia is Daddy's girl...

The above Mp3 file is a talk by Sari grove about why credit card insurance is such a very bad thing...As it happens, the Occupy Wall Street movement is about how banks have taken so much money in bad ways from the little person...This is one such way a self-employed artist can get exploited by a bank...But it also involves the disabled, retired, unemployed, seasonal or part time workers, or those who weren't employed when they said yes over the phone...Important! Listen now... http://grovecanada.wordpress.com/2011/10/31/complaint-filed-october-31st-2011-to-obsi-officially-concerning-systemic-flaw-in-canadas-banking-system-using-td-bank-as-a-microcosmic-example-for-scrutinizing-the-flaw-the/ Then, read the great letter I wrote to OBSI on Hallowe'en, October 31st, 2011... http://www.lautorite.qc.ca/files//pdf/publications/conso/assurance/AMF_insurance-sold-lenders-merchants.pdf Guidelines for how a bank must proceed when selling insurance...

----- Original message -----From: "Joseph & Sari Grove" <[email protected]>To: [email protected]: Thu, 27 Oct 2011 23:03:28 -0400Subject: Submission...3 images attached from Sari Grove... Hello, I am submitting to The Women’s Art Museum Society of Canada for The first thematic exhibition: Attached are 4 files: In order... 1) "Swanee" 75 bs. & 5ft. x 30 in. x 30 in. of Ferrocement sculpture from 2011 by Sari GroveDescription: I wove some nests out of Sisal rope on my hula hoop for wintering Trumpeter Swans...The sculpture began as a signifier for these swans to know this was a safe nesting area for them...From November to April I feed the Trumpeters wild bird seed...This is both for me & for them... 2)"Tempesta" a 36 x 48 inch oil on linen painting from 2010 by Sari GroveDescription: My husband Joseph Grove & I, (who is also an artist) were feeding Mute swans, a family of four, when a seagull tried to steal a piece of bread...The mom swan went medieval on the seagull & we were all frightened by the power of this beautiful creature...It became a painting "Tempesta" or stormy... 3)"Magnolia" a 36 x 48 inch oil on linen painting from 2010 by Sari Grove Description: I was carrying Sky a husky puppy in my arms because he didn't feel like walking...As I showed him the flowers in a public garden, he leaned forward & swallowed a giant Amaryllis...On April 5, 2010, the Magnolia tree bloomed at our neighbour's...The painting became Sky the husky eating the flower in the foreground with the Magnolia blooming in the background... 4) A current C.V., Bio, Statement for Sari Grove in pdf form...(If you need this is an alternate format please email me at [email protected] , I work in Mac & .doc files are so odd for me to work with...)Description: I have troubles putting my life's work on paper...It seems so dull compared to the colours & sounds & life that happened in each line of print...In many ways I see the C.V. as being merely another artwork, as such I try to entertain a bit...Please forgive me...Sari Grove [email protected]grovecanada.ca

Update Comment on June 11, 2012: if you don't feel like reading all of this let me sum this all up...Toronto Dominion Canada trust Bank is full of shit...Why? Because they sold an insurance policy to a self-employed person without telling them that self-employed people are excluded...All this bullshit & analysis & letters from them are a load of crap...If someone is excluded from making a claim because they are self-employed then you don't sell them an insurance policy, & then say 'well, you should have read the fine print'...Fine print excuses are for scammers, fraudsters, criminals, it is the stuff of corporate malfeasance...The fact that this bullshit runs so deep from TD bank to Canada Life Assurance company through to the OLHI & various levels of Canadian government means that our country now stinks...

When someone calls to sell me computer software they say this is WINDOWS blah blah blah, so then I know I am excluded & I say I have a MAC blah blah blah & they say "Oh sorry" & go away...TD Visa card people don't tell you who their insurance is for or who is excluded...They just sell it to you, take your money then load up your life with bullshit red tape answers while they run to commit more phone fraud...They also have sold to retired people (excluded), students (excluded), freelance workers (excluded), seasonal or part-time workers (excluded), disabed people (excluded)...They are totally full of shit & their letters below are just more shit compressed with vomit & verbal diarrhea...Makes one sick just to deal with them...

Update: Wed. June 13, 2012: Oh, yeah...& they SAY they sent me a written thing that supposedly told me all about the whole insurance policy...They SAY...But that is their word against mine...I never got a written insurance policy...Nor did my husband see it in the mail...This is TD Canada trust bank SAYING they sent me a written policy, but I didn't get it...They say they sent it, they say that they have a record of sending it, they say that they got no returned mail...This is all hearsay...They say...I say I didn't get a written policy...So...Who are you going to believe? A bank who is defrauding people using an insurance product that has been PROVEN to be a fraud worldwide already...Or a person who is out over 3 grand now plus $10,000.00 in estimated aggravated damages because of wasting so much time trying to get back that money...This bank, & all the other banks who sell creditor's group insurance are all a bunch of liars...So why should anyone believe them when they say they send out a written insurance policy...Nobody else seems to have seen this policy...A lawyer looked at the written thing which we finally got to see after

months & months of trying to get this refund back...This is how the lawyer described this thing: " OBFUSCATORY"...

For the record, we also never got a copy of the "phone contract" which they quote to us all the time...I heard this rambling piece of shit though...Not one mention of EXCLUSIONS was made...Still these fucking criminals insist that informed consent was reached...Informed consent? Really"...Omigosh our country is full of criminals...Terrorists really...They steal from you with a smile on their face...Now that banks have dumped all their senior employees who might have been honest, they are all left with minimum wage lackeys who have no ethic, no university degree, no experience, & most importantly of all, no INSURANCE LICENCE...

http://business.financialpost.com/2011/10/26/td-bank-exits-obsi/ Read this link about how TD Bank just exited from OBSI (ombudsman for banking services & Investments) because Td bank didn't like how clients were getting positive results...)Read my comment there too! Sari

This is the rude letter I got from Td Bank...  here is the ending of the rude letter from Td Bank... Hi J., (hope that is spelled right) at OBSI, I am sending this complaint by email because the Submit button on the online form wasn't working for me... As per our telephone conversation on Wed. Oct. 26, 2011 at 5:00 pm... Sari Grove grovecanada.ca a website with blog... groveontario.wordpress.com blog You can find us on twitter as grovecanada, or facebook as grovecanada, or my fan page as Sari Grove also, grovecanada.wordpress.com has a blog... Thanks, J., I am requesting that this complaint process be opened immediately, so as to beat the Nov. 1st, 2011 deadline where I would have to file a complaint with ADR Chambers after that time... So if you could stamp this complaint for today, that would protect us from having to go through someone else...(Please) Online complaint form You can use our secure online form to send us your complaint, or a complaint on behalf of someone else. You will need to send us supporting documents, such as the final letter from the firm about the complaint, by fax or mail. Our mailing address is: OBSI 401 Bay St Suite 1505, P.O. Box 5 Toronto, ON M5H 2Y4 Fax: 1-888-422-2865 or 416-225-4722 We use secure socket layer (SSL) encryption to protect the transmission of the information you submit to us when using the form below. * Are you complaining on behalf of someone else? Yes No If you have a complaint, enter your contact information here. Person # 1 Person # 2 (if applicable) Title: Title: Mrs. * First Name: First Name: Sari * Last Name: Last Name: Grove * Daytime Phone: Daytime Phone: 416-924-9725 * Evening Phone: Evening Phone: 416-924-9725 * Email Address: Email Address: [email protected] Mailing Address * Street: 306-15 McMurrich st. Address 2: * City: Toronto * Province: Ontario * Postal Code: M5R 3M6 * Country: Canada Details of your complaint * Type of account this complaint is about: Personal (though we are self-employed so our Personal & our Business accounts are blended) * Name(s) of the firm(s) your complaint is against: TD Bank * Summary of your complaint: Summary of my complaint: In a nutshell, TD Visa took $2,684.70 plus interest from me for Credit Protection Insurance in a coercive & deceptive manner, sold over the phone by non-insurance agents, & I was never told that I as a self-employed person did not qualify...I also did not know I was signed up in the phone conversation as most insurance contract require a signature in writing to confirm that my consent was informed consent...There was also no annual reminder to confirm my enrollment in this policy, so I could have even known I was signed up...It came as a shock to me at the end of August when my husband discovered what we thought was an unauthorized charge, & that is when we found out how much money, $2,684.70 plus interest had been taken directly from our credit card... The fact that a self-employed person was sold this policy without being told that I did not qualify to make a claim for the benefits I consider duplicitous...The fact that the solicitation was bundled with my card reactivation I also consider duplicitous...The fact that credit protection insurance is sold as negative option billing, meaning you have to cancel in order Not to have it I consider unfair business practice...The fact that I have found so many others online who have complained about being sold this while not qualifying because they are self-employed, disabled, students, retirees, seasonal workers, part time workers, or didn't hold a job when signing up, I consider indication of willful fraud on the part of TD..The Insurance Act indicates that if material facts of a policy are not disclosed by the insurer when selling an insurance policy, & it is indicative of fraud, then that contract should be voided & all monies returned to the client...I consider my case valid from this respect...Td has not given me a refund & their ombuds-processes have been remarkably defensive of what has been decided as being a fraudulent insurance product by the international insurance community at large- to such an extent that England has banned credit protection insurance in its entirety, & all Class Action lawsuits in the States have been won by consumers & monies refunded already, with more Class Actions beginning as we speak...I have discovered severe documentation about credit protection insurance online already, & it appears that it is only a matter of time before it is banned in Canada...As such, for now, I am still trying to get a refund & hope that you can help... What follows are three recent letters I have sent complaining about credit protection insurance... 1)First letter: precedent: failure to disclose, TD bank, fraud... From: "Joseph & Sari Grove" < [email protected]> To: "Td Ombudsman" < [email protected]>, "Financial Consumer Agency of Canada" <info@fcac- acfc.gc.ca>, "FSCO" < [email protected]> Date: Tue, 25 Oct 2011 10:39 AM (8 hours 20 minutes ago) Hello, I am still trying to get a refund of $2,684.70 plus interest from TD Visa on Balance Protection Insurance... I am adding an excerpt from a previously decided case that applies to my own: The reason the client was given a full refund on all premiums taken for balance protection insurance is that the client was self-employed, like I am, (& that fact is clearly written on my credit card agreement...) At no time, in the over the phone conversation was I told that a self-employed person would Not qualify for the majority of the benefits of this policy...Had I known this, I most likely would NOT have agreed to this policy...In case precedents, it is not sufficient that a mention of exclusions exist buried in written documents, but that the fact that a self- employed person is Excluded from benefits be drawn to that person's attention when the policy is being sold over the phone... I consider it abhorrent that a policy excluding a self-employed person was sold to me & that I was not told of this exclusion over the phone when you signed me up...It is further abhorrent that TD Bank, TD Insurance, & TD Visa, does not admit they wrongfully sold a policy while failing to disclose material facts about the insurance, in such a way that can be deemed fraudulent... In many, many, documented cases, published online, clients are repeatedly shown to have been sold balance protection insurance, without ever being able to qualify to make a claim...These are the self-employed, the disabled, students, retired people, seasonal workers, part-time workers & the list goes on...The fact that so many people were not told that they would be excluded from making a future claim, indicates more than merely a failure to disclose on the part of the insurer, it indicates a willful act of lying by omission in a grand scheme, on a large scale, & where significant monies have been taken with unfair business practice from clients, in a manner consistent with large scale fraud... As such, I repeat my request for a full refund to my credit card... Sari Grove [email protected] 416-924-9725 grovecanada.ca one of the excerpted examples of a self-employed person getting their refund: "In these circumstances, the financial business should have drawn the term to the attention of Mr D when providing information about the policy. The term was not highlighted in the policy summary – it simply referred Mr D to the longer policy document where the term could be found mid way through a 20-page document. We did not consider that this gave the term sufficient prominence. We decided that if the term had been drawn to Mr D’s attention, he would probably not have taken out the policy. It was unlikely that he would be able to claim under the policy for the most likely cause of future unemployment. We told the financial business to put Mr D in the position he would have been in, if he had not taken out the policy, by reconstructing his credit card account." 2)Second letter: Hello, here is an excerpt form the Insurance Act: "Non- disclosure by insurer 185. Where an insurer fails to disclose or misrepresents a fact material to the insurance, the contract is voidable by the insured, but, in the absence of fraud,..." Ok...But I am looking at voiding a contract in the case of fraud... In 2004, over the phone when activating a renewed TD Visa credit card, I am told I agreed to balance protection insurance... I write, I am told, because I have no recollection of the conversation... In fact I had no idea I was enrolled in this program... Nevertheless, I found out recently that $2,684.70 plus interest had been debited from my TD Visa credit card over the years... When I looked into what this policy was, I found out that self-employed people do not even qualify to make a claim... It appears that I am not alone, that, in fact, tens of thousands of Canadians who are self-employed, disabled, retired, seasonal or part time workers & students have been paying millions of dollars a year total for balance protection insurance that they cannot ever qualify for to make a claim... I believe the lack of exclusionary questions in the telephone call are not merely failure to disclose facts material to this insurance, but in fact knowingly omitted in a manner more concurrent with large scale fraud on the part of the credit card companies selling balance protection insurance... In fact this balance protection insurance has already been deemed fraudulent in England & the United States, & Class Action suits in both countries have refunded all monies to consumers... But Canada is last to this legal party... I am reporting TD Insurance for insurance fraud related to balance protection insurance...For fraudulently selling this product to tens of thousands of Canadians, knowing those people could not ever make a claim...Knowing those people did not qualify for this insurance & on purpose omitting any exclusionary questions in order to exploit & profit from this fraudulent product... This is not a case of one person being misled by one insurance agent...This is a case of a calculated phone sales speech, designed to rope in as many people as possible, with no care if the person could benefit or not...It is so widespread & so much money has been taken from credit card holders, that it constitutes a breach of law, insurance law, a breach of the Insurance Act & a breach of human decency... Please contact me by email or by phone at your leisure, sincerely Sari Grove 3)Third letter: From: Joseph & Sari Grove [mailto: [email protected]] Sent: October-24-11 6:39 PM To: Contact Centre Subject: Balance Protection Insurance... Hello, TD Visa has taken $2,684.70 plus interest from me for something on my TD Visa called balance protection Insurance... I discovered a charge recently, & when I went to have it removed, they told me it was legitimate... That is when I discovered the total amount of damage over the years... Apparently this balance protection insurance was sold to me in a phone conversation many years ago when I was re-activating a new credit card... Apparently they say they sent me something in writing, though I never received or read it if I did... Honestly I was entirely unaware that I had this balance protection insurance at all... My husband checks my statements, & he did not catch the charges either... But even worse, I discovered that a self-employed person is not eligible to make a claim on balance protection insurance at all anyway... When I discovered these unauthorized charges, I thought maybe I could swallow the mistake & just have TD Visa pay off my balance owing on my credit card & somehow that would make it square again... But self-employed people cannot make a claim??? So I was sold a policy in a coercive & deceptive manner, with no annual reminders to ask me if I wanted to renew (which would have at least told me I had this policy), for something that I was completely ineligible for...??? I am hitting a brick wall with TD Insurance, who apparently thinks that everything concerning the sale of this balance protection insurance is done correctly... How can someone sell you insurance if you can never make a claim for it? How is this legal? I am so shocked... I am also depressed at the state of corruption that a bank of this stature can stand behind so obviously a corrupt product... Not only would I like my monies back, but I'd like to see TD Insurance penalized for their unfair business practices... I'd also like to see this whole balance protection insurance banned as a product in Canada in its entirety... Do you agree? If so, can you help in any way shape or form? I have jumped through the appropriate hoops of talking with TD, & have gotten nowhere... The profits from this unscrupulous device are obviously so great as to have clouded their judgement... My husband comes from a military family & all our extra money goes to them...That money taken by TD has being taken away from people who really need it... But worse, it has been taken in an illegal way & legislation needs to be enforced against TD... There doesn't even appear to be any certified insurance agents selling this thing nor administering it, nor even any of the people that I have dealt with... How can non-certified people sell insurance products in Ontario? There needs to be laws about that too... Any help you can give is appreciated, Sari Grove GroveCanada.ca groveontario.wordpress.com [email protected] 416-924-9725 Notes: I became aware of unauthorized charges on my TD Visa credit card only recently...It was just the end of August this year 2011, that my husband saw the charge & we both had no idea what it was for...This was because we hadn't made any new purchases on the card in a long time (2 years maybe?), & yet there was this new charge...because the statement was bare except for this charge, we were able to notice it...Balance protection ins. on your credit card statement is very hard to spot, since it only appears if you carry a balance, but if you are carrying a balance it gets buried in the pile & looks like a bank statement fee or an annual credit card fee...Online complaints from other consumers indicate that a high percentage do not even know they have this insurance product at all, for many many years- which indicates that this product is designed to be hidden on purpose... Name of most recent person at Td Insurance who sent me a letter: Michael Brunette wrote the most recent final position letter...no email address was given...no phone number was given... brief details of steps taken to date in order to try & resolve this matter: 1)Called TD Visa to have unauthorized charges removed 2)Was told the charges were for credit protection insurance...Said I didn't sign up for it & asked for an investigation...Cancelled whatever this thing was immediately... 3)read about credit protection insurance online, CBC Marketplace did a documentary viewable online warning that this was a scam...Discovered that self- employed person could never have qualified anyways... 4)Was told there was a phone record of me saying yes to this... 5)wrote letters to TD Bank, Easyline phone service who does the phone sales for TD, Visa, Insurance, saying a phone record was not a contract... 6)wrote letters to above saying self-employed people do not qualify, so why was I sold this? Included the fact that my credit card agreement with TD Visa states clearly that I am self-employed... 7)wrote to the FCAC to have them investigate TD Insurance for unfair business practices & asked for a 250K penalty to be applied to them... 8)wrote to the underwriter Assurant Solutions/ABLAC to see if they could help 9)Spoke to the ombudsman for GIO about this matter & advice 10)spoke to two lawyers, but did not retain them yet... 11) wrote to class action lawyers concerning a possible class action lawsuit, did not retain them yet... 12) went through the TD bank ombudsman, & though they referred me to the TD Insurance ombudsman, the insurance ombudsman said this was a matter for the TD bank ombudsman...The runaround... 13)received rude final letters, one from Indra Satram, one from Michael Brunette, which just repeated like a template that they were not going to give me my money back with no apparent intellectual listening to the facts of the case...Form letters basically copied & pasted from a template is what I got... 14)Spoke to a branch manager in person at TD bank at Bay & Bloor, who made some calls & also found herself stymied by runaround, delays & lack of authority in finding a person who would take responsibility... 15)Wrote to FSCO, & was told to fill out a complaints form... 16) Published all my writings on this subject on my blogs & websites & Twitter & my Facebook business page & received an email from a lady who thanked me for publishing this information, & who got a refund soon after because her son had been signed up for credit protection insurance, but he was a student...Apparently the fact that he was a student & could not qualify for credit protection insurance claims was sufficient for the mother to get a refund immediately for her son...I question why TD Insurance has not given me a refund based on the same exclusionary fact- namely that I am & have always been self-employed... 17) Some of these steps are not necessarily in the correct order...I have probably spoken & written to more organizations & people than I have noted above...The Consumer Protection agency of Ontario also helped me over the phone... * Have you completed resolution process at your firm? (Help) Yes (Yes) * Have you started legal proceedings? (Help) No (No) Additional information How did you hear about OBSI? We were referred from another organization online, here is the link- http://www.canadianlawsite.ca/consumer-protection.htm#d If you have completed the complaint resolution process at your firm, please mail or fax us that letter along with any other supporting documentation. (OBSI Address above) Submit © Copyright 2006 OBSI All rights reserved

Ok, so in the picture is a cutout of the swan sculpture, laid on top of an original painting...This was a quickie tryout, you can do the edges better if you take some time...(You can also cutout the middle section where the neck meets the body, or other holes like that too...) Ok, here's how... 1)On your Mac (sorry everybody else), open the picture you want to cutout in Preview... See the "Select" button at the top of your picture? Go in to those choices & choose "Smart Lasso"... Then just draw a line all the way around the shape you want to cutout...(a thick line appears immediately)...(Once the shape is closed, like you have joined your beginning line to your end line, so it is a closed shape, the lines will change from thick paint line to a shimmering dotty line)... Now go to "Edit"...& choose "Invert selection", then choose "Cut"... Now you have your cutout shape! 2) Now say you have saved your cutout image & now want to put it over top of a different background...Open the cutout image in Preview, select the Smart Lasso tool again, & go around your shape until you are back to your first lines & the shape is closed...Now go to Edit, & click "Copy", then open your new background image picture & click "Paste"...(just a heads up, make sure to close the first image, the one you copied from before trying to save your new pasted onto picture...) That is neat eh? & totally free if you own a Mac... Cool other tip: http://www.fring.com/ Fring is an App you can download for free to your Ipod...Once you get Fring, you can add FringOut as a pay as you go, the first credit is $6.99...In Canada that means you can send or receive phone calls to anyone from your Ipod for about 7 cents a minute, pay as you go, no plan...That is neat! (You use free wifi to do this...)

How to do sculpture in ferrocement...

|

RSS Feed

RSS Feed